Is Your Dairy Business a Good Investment Risk in your Banker's Eyes?

Is Your Dairy Business a Good Investment Risk in your Banker's Eyes?

Profitable dairy businesses are able to generate adequate income within a given year to pay expenses, repay debts (interest and principle), and provide living expenses or owner withdrawals with some income left to reinvest in the business now, as needed, or in the future, if desired. This definition is somewhat different than one used in management articles which often only reflect the income and expense side of this definition. But, to be sustainable and to continue as an on-going business, dairy operations must provide personal income, return on their investments, and increased wealth for their owners. Financial and performance aspects of a dairy business must be integrated.

Balance sheets, also referred to as net worth statements, are used to determine the financial position of a business. They reflect the financial position of a business at a particular point in time and, as such, need to be updated at the same time each year so the owner and their banker can compare their financial position across years. Balance sheets reflect the value of assets and liabilities of a business and the proportion owned by the business’s owner. Bankers use information from a balance sheet to determine the risk associated with lending capital to your business. Essentially, they are determining the probability or risk as to whether you will be able to repay the loan and, if not, do you own assets that will allow the bank to recoup the value of the loan.

For dairies and other agricultural enterprises, both the business’s assets and liabilities are broken down into three different “useful life” spans. These “life spans” include (1) current or those used or available to be used within the next year, (2) intermediate or those used or replaced within 13 months to 10 years (i.e. cows/heifers, equipment), or (3) long term (i.e. land or buildings) assets. Bankers and financial advisors may calculate 16 to 21 different financial ratios from the information in a balance sheet with each person having their preferred set of financial indicators, terminology, and benchmarks. Essentially, these farm financial ratios evaluate 5 different areas of interest. These areas include calculations reflecting the liquidity, solvency, financial efficiency, repayment ability, and profitability of a business. Your banker calculates ratios reflecting these 5 areas to determine the overall risk and ability to secure one’s loan with collateral. Spreadsheets or calculations done by hand can be used to calculate these financial ratios using information noted on a balance sheet. The results from these calculations then can be used, along with production records, to integrate the financial and production aspects of a dairy business. They also can be shared with one’s banker or financial consultant along with a cash flow and balance sheet, as a starting point for a scheduled financial discussion. For this article, we will look at each of these 5 financial areas and an example calculation reflecting the financial position for each one.

Liquidity - short-term debt repayment ability

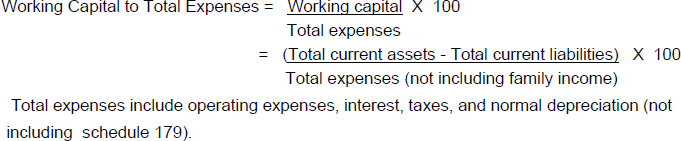

Liquidity reflects how well a farm can generate “cash without disrupting normal operations” to pay current and on-going operating expenses and debt in a timely manner. Some use the term ”working capital” in association with this assessment. This financial ratio only incorporates what are termed current assets and liabilities. Current assets are those assets which could be sold (i.e. steers, corn grain), used (forages in storage), or turned over (i.e. cash, prepaid expenses) within the next 12 months as part of “normal business activity”. Current liabilities would include outstanding accounts payable (bills), accrued interest on debt, and the current portion of term debt which should be paid within the next 12 months. The value of dairy cows and heifers and equipment are not included in this calculation as they are considered “productive assets” and are needed for the continued generation of income.

The higher the percentage of working capital (total current assets – total current liabilities) in relation to total expenses, the stronger the business and the better the dairy business will be able to survive fluctuating prices received for milk and/or higher costs associated with inputs. Percentages greater than 25% are considered favorable and should result in the ability of the dairy business to cover 3 months of expenses or 6 months of a “feed bill”. When this percentage drops below 15%, concern is raised since less than 1 month of expenses are in reserve.

Some financial advisors and bankers prefer to calculate the “current ratio” as an indicator of the short term ability of a business in making payments or as a measure of liquidity. This financial indicator takes into consideration the total current assets in relation to current liabilities. Ratios greater than 1.5 are considered “good” and those below 0.8 to 1 are generally considered problematic.

![]()

Solvency reflects longer-term debt repayment ability

Solvency reflects one’s ability to repay debts in the long-term and is used to determine if a business has the ability to carry more debt. Essentially, this financial calculation reflects what financial proportion of your assets (i.e. feed, cattle, land, and equipment) you own versus those you owe. Solvency is reflected in the debt to asset ratio or the inverse, equity to asset ratio. All assets, (current, intermediate and long term) are divided between those owned (equity) and those owed (debt or liabilities). Economists evaluating agricultural businesses consider debt to asset ratios under 30% as “good” and the danger zone being at or above 70%. Since dairies receive a “monthly income” in the form of a milk check, some financial advisors adjust the benchmarks to 40% or less being good and danger zone when it is greater than 60%. Those dairy businesses with poor debt to asset ratios need to look for ways to add additional income and/or reduced expenses, ways of restructuring debt through refinancing at a lower interest rate or longer terms, or selling some unneeded assets. Oftentimes, no new borrowing is recommended or allowed until positive changes occur resulting in a lowering of the debt to asset ratio.

![]()

When evaluating solvency, some bankers may assess the debt to asset ratio for current, intermediate, and long-term assets separately. Assessment for each of these lifespans for assets may impact the financial ability to make improvements in the future. High current debt to asset ratios may raise questions regarding a business’s ability to make payments as they become due. A high intermediate debt to asset ratio may spell issues replacing capital, i.e. equipment, as needed in the future and high long-term debt ratios may limit expansion capacity in the future.

Financial Efficiency

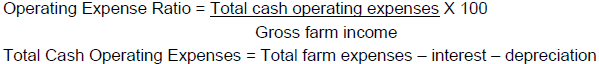

Financial efficiency reflects a business’s ability to control costs associated with either cash expenses or capital purchases while at the same time maximizing income. Separate ratios are calculated to reflect cost containment of cash expenses versus capital expenditures.

The operating expense ratio reflects how much is spent on cash expenditures to generate $1 of income. Cash expenses include operating expenses minus interest and depreciation. The lower the ratio, the better the evaluation of financial efficiency. Ratios of 65 to 70% or lower generally are considered “good”. At this ratio, $0.65 to $0.70 in expenses generates $1 of income. When this ratio goes above 80 to 85%, major concerns are raised and management changes are needed which can increase income and/or contain expenses without compromising milk/cull cow income.

Another aspect to evaluate relates to the amount of revenue generated from each dollar of assets, known as a capital or asset turnover ratio. This ratio indicates how well your business is generating income in relation to assets held. With this ratio, the higher the ratio the better and excellent marks are given when the ratio is greater than 35 to 40% and major concerns are raised when the ratio is less than 20 to 25%. One should always reassess if assets, especially equipment, are needed and make sure they are not being under-used or being utilized inefficiently. I think we all have heard the saying, “too much green/red/blue paint”.

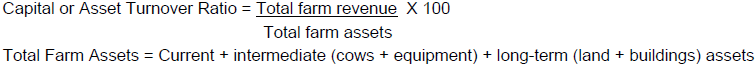

Repayment Ability or Capacity

Repayment ability or capacity measures a business’s or person’s ability to repay annually scheduled principle and interest payments on “term debts” (i.e. loans for equipment, cattle, or land). Values greater than 150% are considered “good” and 110 to 150% are in the cautionary area. Lower values signal term debt may need to be restructured along with management changes to improve farm income, additional sources of farm and non-farm income, and reductions in expenses. To a banker, low values may also indicate a high risk of non-payment, if applying for a loan, and a reason for not underwriting a farm loan.

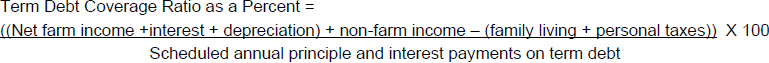

Profitability

To be sustainable, businesses must generate enough income to cover their expenses, “pay” their owners for their invested time, and make a return on the investments in capital. Profitability of a business is often calculated as the rate of return on assets or ROA. The higher the rate of return, the more profitable the business. For dairies, ROAs greater than 5 to 8% are considered “good”. Obviously, rates of return vary from year to year and as such need to be averaged over time, like investments in the stock market. Generally speaking, one would like to see a return on investment at least greater than the weighted average of interest rates on loans for a dairy business and/or the long-term inflation rate.

![]()

Complete These Assessments Yearly

At least yearly, if not quarterly, each of these financial areas, needs to be reviewed and assessed as to whether changes need to be made. Regularly reviewing the financial status of a dairy business helps one integrate production/performance-related aspects with the business/financial goals for the operation. By keeping an on-going and retrospective analysis of each of these areas, one can determine if they are making headway toward their financial and performance goals. Sometimes progress and successes are hidden within a pile of papers and numbers!!! We just need to take some time to evaluate what is there.

Author: Donna M. Amaral-Phillips, Jerry S. Pierce